Maximize Your Budget.

Reduce Payroll Taxes.

Support Your Team.

Zero Budget Impact.

If you’re not using PHI, you’re overpaying payroll taxes every month.

PHI connects you to significant FICA tax reductions while providing comprehensive wellness benefits to your team—without requesting additional budget allocation.

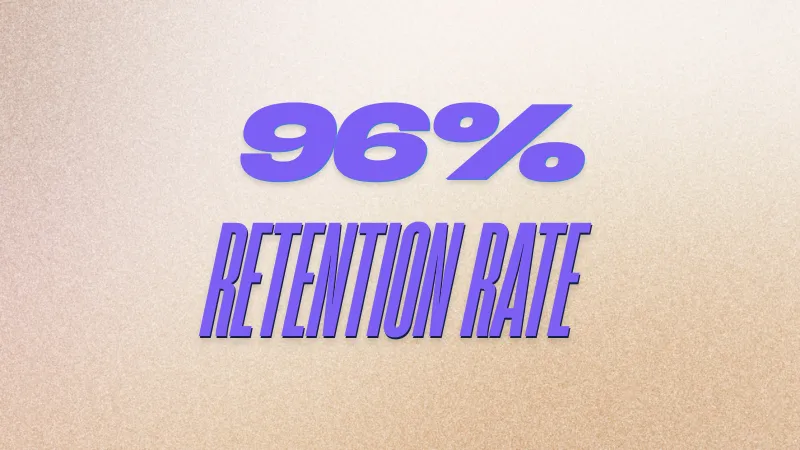

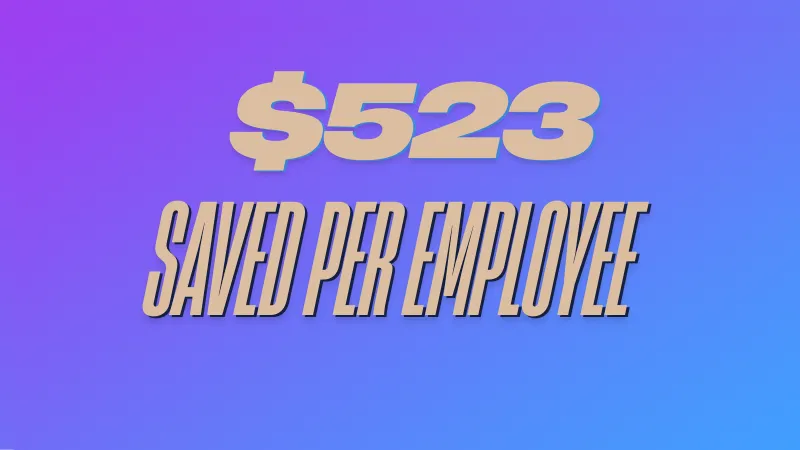

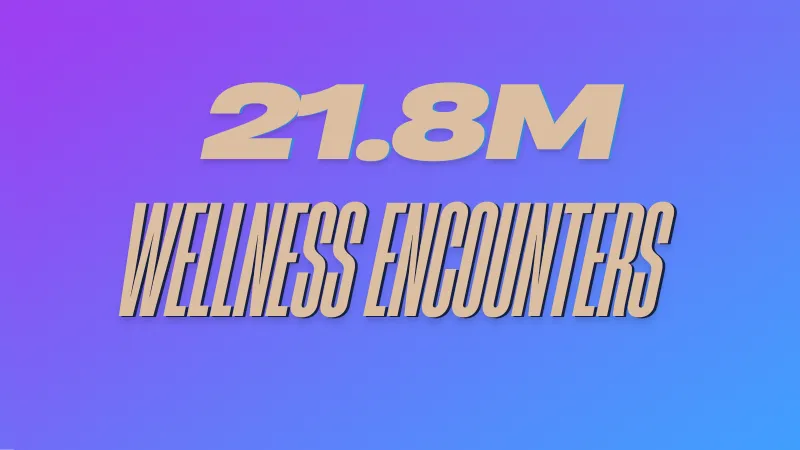

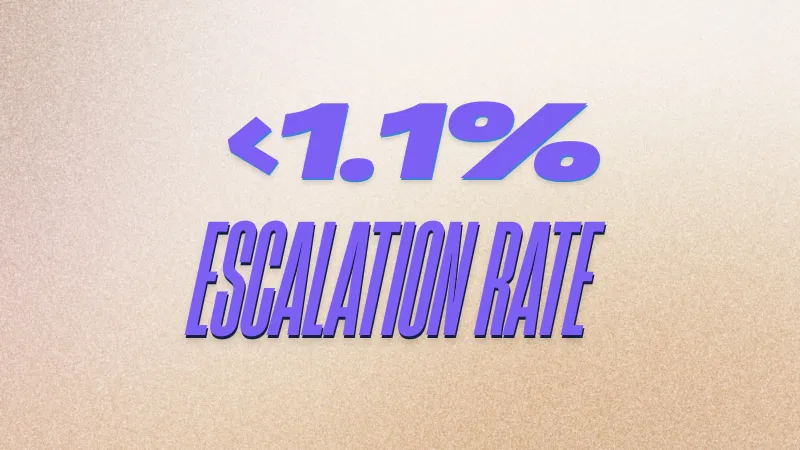

2024 Impact-at-a-Glance

Hands-Off

Done-For-You Process

We handle everything so you don't have to. Our team manages complete onboarding, staff education, regulatory compliance, and IRS alignment—delivering a fully turnkey solution with 24/7 ongoing support.

No procurement headaches. No budget negotiations. No additional administrative burden. We provide seamless integration that works within your existing payroll structure while ensuring full federal compliance.

Your only job is to enjoy the benefits: happier employees, reduced turnover, and significant annual savings that go straight to your bottom line.

What Are The Benefits?

PHI delivers measurable value to both your organization and employees—with government backing and no impact to your budget

Average Impact Per Organization

- Average $500 FICA tax savings per employee annually

- Enhanced recruitment and retention capabilities

- Reduced overall healthcare costs

- Improved employee morale and productivity

- Zero net cost implementation

- Stand out from competitors in talent acquisition

- Up to $100,000 in cash value whole life insurance

- $1,500 additional retirement benefits annually

- Comprehensive health services at no cost

- No reduction in take-home pay

- Personalized health dashboard access

- Dedicated health coaching and telehealth

ℹ Government Recognition & Support

PHI is recognized and supported by the Departments of Health and Human Services (HHS), Labor, and Treasury under Affordable Care Act wellness program provisions, ensuring compliance and regulatory confidence for public sector organizations.

Meet Cynthia Chapman

PHI Specialist | Principal Business Consultant

Cynthia D. Chapman is a seasoned financial strategist with 30+ years of experience in marketing, insurance, and strategic planning. Today, she helps public-sector organizations and mission-driven businesses unlock hidden savings and strengthen their budgets through the Preventative Health Initiative (PHI).

As Senior Vice President at Bank of America, she spent nearly a decade overseeing strategic marketing initiatives across multiple business lines. That foundation—combined with her MBA and nearly 15 years as a licensed insurance professional—uniquely equips her to help leaders navigate complex financial decisions with confidence.

Specialties include:

✅ PHI implementation for public entities

✅ Tax-advantaged employee benefit strategies

✅ Budget optimization for businesses and nonprofit organizations

Her passion: unlocking hidden savings that strengthen budgets without cutting people or programs.

Service Area: Nationwide

Contact: 336-254-9490 | [email protected]

Our Guarantee to You:

100% Compliant

We guarantee this program to be fully IRS, ERISA, HIPAA, and ACA compliant. Our federally aligned tax strategy has been thoroughly vetted and approved for public sector implementation.

Guaranteed Eligibility

We guarantee your organization qualifies if you have 10 or more full-time employees (30+ hours per week) earning $25,000+ annually by federal definition. No exceptions, no surprises.

Zero Risk Implementation

We guarantee complete done-for-you service with 24/7 support and zero net out-of-pocket cost. If we can't deliver exactly what we promise, we'll make it right.

Want to work with us?

Project Blue is bringing the best practices of Fortune 500 Companies to public entities, nonprofits, and businesses of all sizes. Project Blue was founded on the premise that EVERY business owner should take advantage of every incentive program that they are legally entitled to claim.

© 2025. All Rights Reserved. | Project Blue is a Wholly Owned Subsidiary of Better Tomorrow Financial Group | Privacy Policy | Terms and Conditions.